https://ift.tt/elGuzik Bank of America, Goldman Sachs, JPMorgan, and UBS have shared their predictions about the Federal Reserve raising ...

Bank of America, Goldman Sachs, JPMorgan, and UBS have shared their predictions about the Federal Reserve raising interest rates further. Bank of America and Goldman Sachs, for example, now expect the Fed to raise interest rates three more times this year.

Major Banks Predict More Fed Rate Hikes

As the U.S. Federal Reserve continues its fight against inflation, several major banks — including Bank of America, Goldman Sachs, UBS, and JPMorgan — have shared their predictions about how much more the Fed will raise interest rates this year.

Goldman Sachs said in a note Thursday that it now expects the U.S. central bank to raise interest three more times this year after data released Thursday pointed to persistent inflation and a resilient labor market. The bank, which previously predicted 25-basis-point rate increases in the Fed’s March and May meetings, now expects another rate hike in June. The firm’s economists, led by Jan Hatzius, head of the Global Investment Research Division and chief economist, detailed:

In light of the stronger growth and firmer inflation news, we are adding a 25bp (basis points) rate hike in June to our Fed forecast, for a peak funds rate of 5.25%-5.5%.

Bank of America Global Research similarly expects to see three more interest rate increases from the Federal Reserve this year. The bank said earlier that it expected the Fed to raise interest rates by 25 basis points each in its March and May meetings. Bank of America now expects another 25-basis-point rate hike in the Fed’s June meeting, which will push the terminal rate up to a 5.25%-5.5% range. The bank explained in a client note this week:

Resurgent inflation and solid employment gains mean the risks to this (only two interest rate hikes) outlook are too one-sided for our liking.

European investment bank UBS also said it expects the Federal Reserve to raise interest rates by 25 basis points at its March and May meetings, which may leave the Fed funds rate at the 5%-5.25% range. While most people are not expecting the Fed to cut interest rates this year, UBS estimated that the U.S. central bank would ease interest rates at its September meeting. The global investment bank recently wrote in a client note:

We expect the FOMC (Federal Open Market Committee) to turn around and begin to cut interest rates at the September FOMC meeting.

Meanwhile, JPMorgan Chase has forecast the terminal rate at 5.1% by the end of June. JPMorgan CEO Jamie Dimon said in an interview with Reuters last week that the Federal Reserve could raise interest rates above the 5% mark. Emphasizing that it is too early to declare victory against inflation, Dimon opined:

It’s perfectly reasonable for the Fed to go to 5% and wait a while.

However, if inflation comes down to 3.5% or 4% and stays there, “you may have to go higher than 5% and that could affect short rates, longer rates,” the JPMorgan executive cautioned.

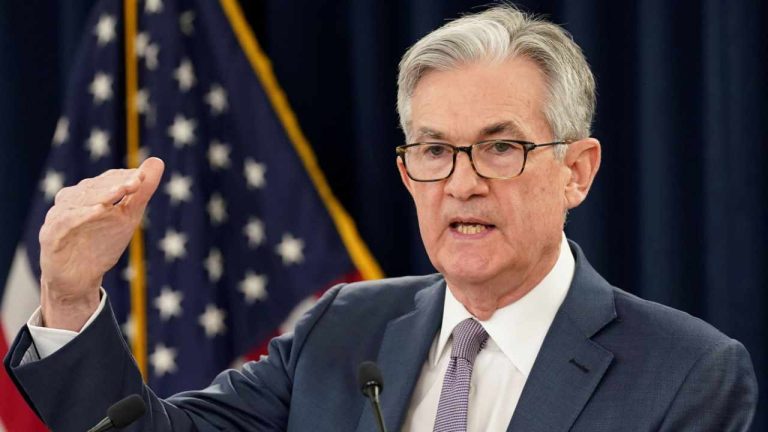

Federal Reserve Chairman Jerome Powell and several other Fed officials have said that more interest rate hikes are needed to curb inflation. A poll conducted by Reuters, published Tuesday, showed that 46 out of 86 economists have predicted that the Federal Reserve will increase interest rates by 25 basis points in March as well as May.

Do you agree with Bank of America, Goldman Sachs, UBS, or JPMorgan about the Fed hiking interest rates further? Let us know in the comments section below.

from Bitcoin News

via RiYo Analytics

ليست هناك تعليقات