https://ift.tt/3naIxXc Veteran trader Peter Brandt has shared “a sacred trading rule” he uses in response to a comment about buying bitcoi...

Veteran trader Peter Brandt has shared “a sacred trading rule” he uses in response to a comment about buying bitcoin as the price of the cryptocurrency continues to fall. “Never add to a losing trade,” he affirmed.

Peter Brandt Offers Trading Advice

Veteran trader Peter Brandt has a trading suggestion for anyone considering buying the dip. Brandt has been a futures and FX career trader since 1975. He is a chartist and the author of the Factor Report. He trades a variety of markets, including Dow futures, bonds, corn, crude oil, European wheat, Osaka Dow, U.S. dollar, and sugar.

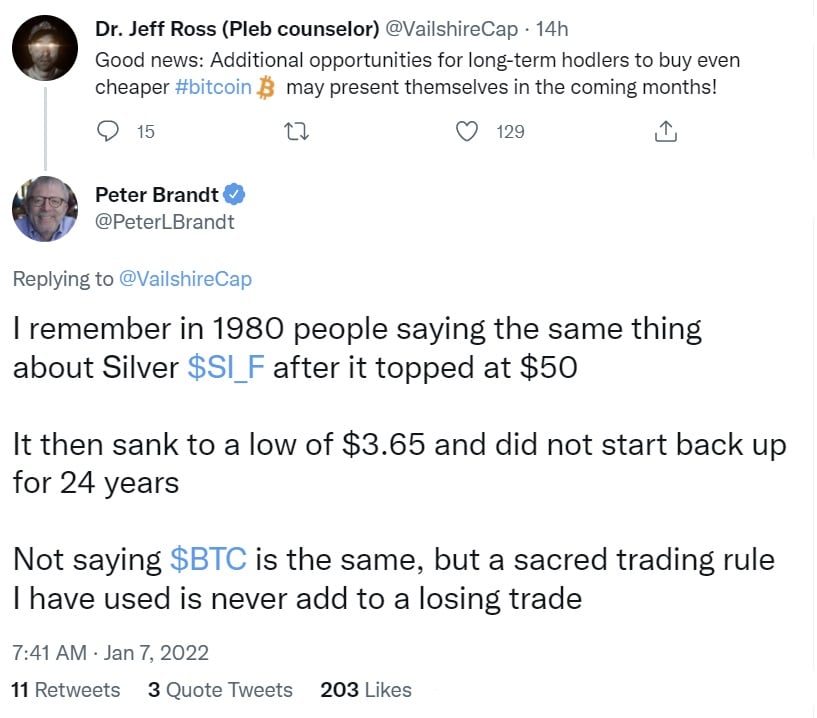

Replying to a comment on Twitter stating that there may be additional opportunities for long-term hodlers to buy even cheaper bitcoin in the coming months, Brandt wrote:

A sacred trading rule I have used is never add to a losing trade.

He explained in a tweet that people were saying the same thing about silver futures in 1980 after it topped $50. “lt then sank to a low of $3.65 and did not start back up for 24 years,” he stressed. The trader clarified, however, that he is not predicting that bitcoin will follow the same path.

The price of bitcoin has fallen significantly this week, losing over 10% in the past seven days. At the time of writing, the price is $41,657.45 based on data from Bitcoin.com Markets.

Brandt commented on bitcoin’s violation of the parabolic advance on the Bitcoin Live discussion Thursday.

However, he tweeted Friday: “I saw the violation of the parabolic advance and commented on it in real time to members of Bitcoin Live in real time, but in hindsight, I might not have taken the event seriously enough. We’ll see.”

He followed up with another tweet. Noting that “Some view predictions as a ‘one-and-done’ event. I am [a] student of Bayesian probability. Predictions and analysis must always morph relative to the events of the time,” he concluded:

When circumstances change, predictions must change. The parabola might not be the driving force in BTC.

What do you think of Peter Brandt’s advice? Let us know in the comments section below.

from Bitcoin News

via RiYo Analytics

No comments